Leasing installments are tax deductible for companies if the vehicle is used for business purposes, but not for private individuals like Peter.

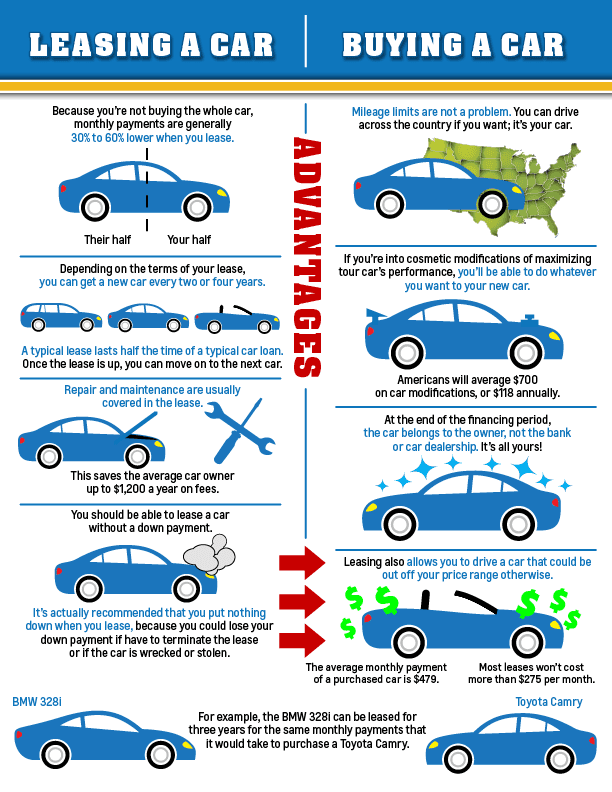

In addition, leasing vehicles generally require comprehensive insurance. At present, depending on the offer, leasing installments accrue interest of 3.9% to 5.9%, with lower rates in some cases even without manufacturer promotions.

#Car lease vs car loan calculator plus#

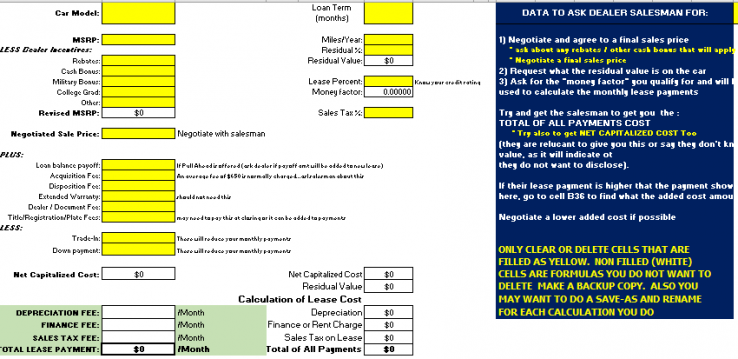

With the leasing installments, Peter pays back part of the amount still outstanding for the vehicle after the deposit each month, plus interest. This Excel loan calculator template makes it easy to enter the interest rate, loan amount, and loan period, and see what your monthly principal and interest payments will be.

He can pay off the remaining sum and gain ownership of the vehicle, if the leasing agreement permits this. Use this car lease calculator to estimate your monthly payment to: Prepare yourself to negotiate with a dealer. Car leasing vs financing in Canada doesnt have to be hard. Auto Car News Car Leasing Vs Car Loan: Fresh view in the new normal of Covid-19 times Car Leasing Vs Car Loan: Fresh view in the new normal of Covid-19 times Today, buying a.He can return the car to the leasing company.Once the agreed term expires, he has three options: To calculate your auto equity, subtract the remaining amount on your car loan from your car’s value (as determined by Kelley Blue Book or a similar resource). The leasing company continues to own the car Peter is merely the holder and pays for its use.

The terms and conditions are governed by a leasing agreement between Peter, the garage and the leasing company. Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost, minus additional fees that lenders may enforce. If Peter leases a car, he will pay a deposit and monthly leasing installments for a defined term and number of kilometers (for instance, 10,000 kilometers a year).

0 kommentar(er)

0 kommentar(er)